Income Redistribution and Energy Consumption

February 27th, 2009Posted by: Roger Pielke, Jr.

[UPDATED]

The WSJ notes today of Obama’s cap and trade revenue generation plan that it is also highly redistributive:

A fundamental question is how the government will distribute the billions of dollars in revenue generated through a emissions trading system. Lawmakers from states dependent on coal and heavy manufacturing are expected to demand that more money go toward their constituents, since they will experience higher costs associated with the transition to low-carbon energy sources.

Mr. Obama’s aides say his plan would provide a refundable tax credit of up to $400 for working individuals and $800 for working families. The credits would phase out between $150,000 and $200,000 for a married couple, and between $75,000 and $100,000 for an individual.

“This is going to change the distribution of wealth potentially for a century,” said Dallas Burtraw, an economist at Resources for the Future, a nonpartisan Washington think tank.

An astute Prometheus reader comments that such a redistribution could have the effect of increasing energy consumption:

It is not inconceivable in that case that the combination of relative “income” and “price” effects across the income spectrum in the US could lead to increased energy consumption. (just imagine what you might expect to happen if you took 5% of income from the top 10% of income and redistributed that among the lowest 10%. Energy consumption would almost certainly rise due to the income effect. If cross price elasticity for energy is low as you imply and I would agree, there would be little or no offsetting reduction from substitution.

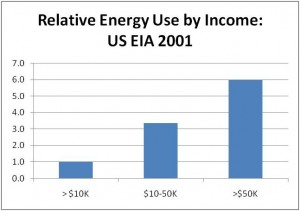

Here is a quick graph of income versus energy use using 2001 EIA data (pdf), which is strongly suggestive that income redistribution will indeed lead to higher energy consumption.

Surely there is some good academic literature on the relationship of income and energy consumption in the United States, please offer pointers in the comments.

February 27th, 2009 at 7:34 am

Wouldn’t it be wonderful to have Democrats actually explain what they think the optimum tax burden should be for each quintile of earners? The Bush tax cuts dramatically shifted the tax burden away from the middle class earners and onto the highest earners. (It also shifted the tax burden slightly to the future, i.e. from older taxpayers to younger ones).

There seems to be some kind of addiction to income redistribution that fails to ever articulate what the optimum allocation of the tax burden should be. Rather than dozens and dozens of byzantine methods to move money around, how about a simple, transparent change in the tax code to encompass all this?

Voters might even understand what was being proposed and we could have a national debate. Assuming that Democrats really desire honesty, transparency, debate and voter participation.

February 27th, 2009 at 3:43 pm

What exactly have you plotted above? I can’t see how it follows from the data linked.

The CBO has looked at this in some detail. See

http://www.cbo.gov/publications/collections/collections.cfm?collect=9#pt2

In particular:

Options for Offsetting the Economic Impact on Low- and Moderate-Income Households

and:

Trade-Offs in Allocating Allowances for CO2 Emissions

I’ve looked at a lot of model results, and I’ve never seen a scenario where income effects dominated substitution effects. Two possible reasons for this: it’s not the average share of income per group that matters, but the marginal share, which is smaller; price elasticity may simply be high enough to overcome any income effect.

Looking at the CBO data (first reference, table 1, energy income elasticity of about .4), if you completely redistributed income such that everyone became average, energy expenditures would go up 11% absent a price response. It would be hard for a carbon tax or market to accomplish that. For any plausible combination of energy price increases (say, 2x), flat rebates, and price elasticities (say, |e|>0.05), energy consumption goes down.

February 28th, 2009 at 1:32 am

Of course, the idea that ‘energy consumption goes down’ is presumes that the energy was not being consumed for a good reason and that there are no losses associated with the reduced consumption.

For example, low cost commuting allows companies to have a more optimal workforce because they can hire workers who live a longer distance from the place of work. Increase the costs of commuting enough to force people to choose less optimal work based on where they can afford to live and you could end up losing more in productivity than one gains with reduced energy consumption.

IOW – specifically increasing the cost of energy will have far reaching and unpredicatable effects on the economy and it is naive to assume that reduced energy consumption is necessarily a good thing.

February 28th, 2009 at 11:54 am

I think Obama plans a massive increase in gasoline taxes. Both Chu and Holdren expressed the view that US transportation fuels should be taxed like europe. This equates to about $3/gallon. Gasoline alone is 9M BBL a day. 9MX42X365X$3=about $400Billion a year. He will justify it as a down payment on global warming.

March 1st, 2009 at 4:57 pm

Regardless of what it is called (cap-and-trade, carbon tax, tax-and-dividend,carbon credits, etc.), it is at the core the Soviet “Turnover Tax”. It is designed to limit demand to what is planned / allowed to be produced / used.

Since energy is required for every human activity, it is ideal for a Command Economy.

It supports “Share The Wealth” in Hansen’s version.